Don’t ignore your creditors – especially the taxman…

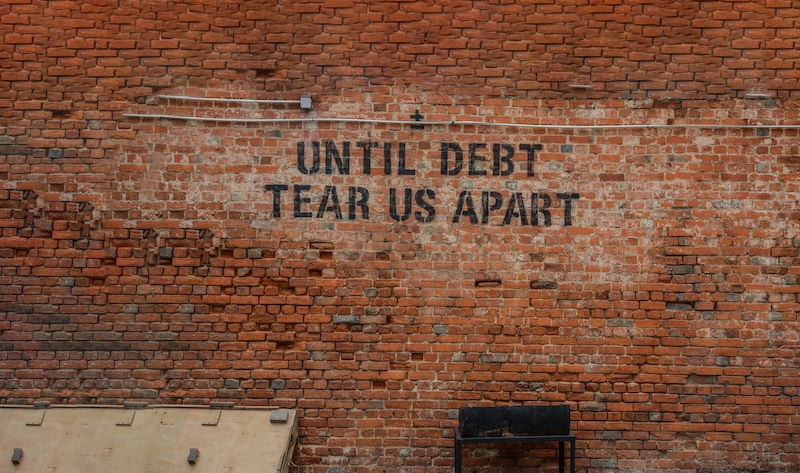

The burden of debt can be all-consuming. It’s one of the most stressful experiences a person can endure, causing sleepless nights and ill health, fracturing personal and professional relationships.

Unfortunately, many UK companies are experiencing high levels of debt as they attempt to rebuild their business in the wake of the pandemic. So how can you best cope with this debt?

Ask any debt counsellor or trusted business advisor and the first and most important piece of advice they will give you about your debt is this: DON’T IGNORE IT!

It’s very easy to stick your head in the sand. But it’s vitally important you address the issues around your debt as soon as they arise.

The Step Change debt charity advises: “If you’re struggling to deal with your debts, it can be really difficult to open letters or pick up the phone.

But ignoring them is only going to make this harder in the long term. Try to get into the habit of opening and reading letters as soon as they arrive.”

They advise that if you don’t, you’ll miss important paperwork, such as:

- Your creditor telling you they’ve passed your debt to a debt collection agency.

- Default notices.

- Court action or a letter of claim.

- A statutory demand, the first step for a creditor trying to make you bankrupt.

It added: “You’ve got a strict deadline to reply to some of these letters if you want to avoid your creditor taking further action, so ignoring them is not a good idea.”

Debt to HMRC

It’s particularly important that you deal with any debt you have to HMRC diligently and professionally. The tax authority has extensive powers of enforcement, but it also has channels of support, such as a Time to Pay Arrangement.

HMRC says: “If you cannot pay the tax you owe in full and on time HMRC can work with you to find a way for you to pay what you owe as quickly as possible [and] in a way that is affordable for you.”

However, it warns: “If you do not respond when we try to contact you we may either visit you at your home or business address to help us

understand your circumstances so we can work with you to settle the tax you owe, or use a debt collection agency to discuss settling your debt.”

During such a visit HMRC will ask about your financial situation and your ability to pay. It will try to agree how best to settle your debt, which might be making one full payment or paying through instalments using a Time to Pay Arrangement.

So what can you do?

Before you start negotiations with any of your creditors, including HMRC, you can improve your chances of a satisfactory outcome by seeking the help of a licensed insolvency practitioner, who (despite their name) specialise in business rescue.

Their experience and know-how means they can show you the best way to deal with your creditors and guide you through the process. In some cases, they can step in and formally negotiate more favourable terms on your behalf.

Whichever approach best suits your company and situation, be assured that their expertise will be invaluable to you in your dealings not just with HMRC but with other creditors, too.

The good news is that, according to HMRC: “In four out of five cases we reach an agreement with our customers” – proving the old adage that ‘it’s good to talk’.

If your company has debts it cannot pay and you’re facing difficult choices, our business rescue and insolvency experts can help to find a solution to your challenges. Call us on 01455 555 444 or email [email protected]m and we will call you back.